Why Refuse “Advantage?”

“Medicare Advantage” is NOT Medicare!

If you choose a MEDICARE REPLACEMENT PLAN (Medicare Advantage), the doctor recommends a treatment plan, but the insurance company is now in between you and your doctor — weighing in on whether the treatment is appropriate, or too expensive.

Medicare Advantage plans are referred to in the Federal Registry by CMS as Part C – MEDICARE REPLACEMENT PLANS (Medicare Advantage). Medicare Advantage plans are not traditional Medicare, nor are they a supplement to Medicare benefits. If you have a MEDICARE REPLACEMENT PLAN (Medicare Advantage), you have given up your traditional Medicare benefits to an insurance company. In turn, they agree to manage your healthcare such that they remain a profitable company. In other words, you are giving away significant Medicare benefits to a private entity who can then consider profitability when evaluating your healthcare needs.

On the other hand, when traditional Medicare provides your primary insurance coverage, your doctor will decide which treatments are medically necessary and then you and your doctor, together, will choose the appropriate course of treatment for you without having to satisfy an insurance company.

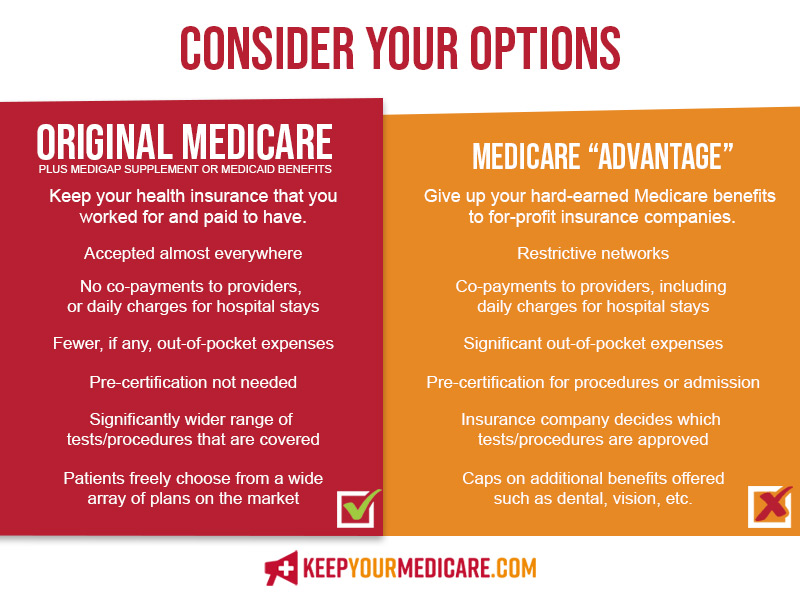

Shortcomings of MEDICARE REPLACEMENT PLANS include:

- Restrictive Networks

- Co-payments to providers, including daily charges for hospital stays

- Significant out-of-pocket expenses

- Pre-certification for procedures or admission

- Insurance Company decides which tests and procedures are approved

- Caps on additional benefits offered such as dental, vision, etc.

One way MEDICARE REPLACEMENT PLANS (Medicare Advantage) can negatively influence healthcare is requiring pre-authorizations for most procedures and admissions — then they often deny coverage. Additionally, the pre-authorization process can take so long that the patient is often left suffering while waiting for unnecessary approvals after the doctor has already ordered the procedure. Medicare does not require these pre-authorizations.

Additionally, MEDICARE REPLACEMENT PLANS (Medicare Advantage) can negatively influence post-acute care. Though your doctor may order a stay in a Skilled Nursing Facility (SNF), Long Term Acute Care Hospital (LTACH) or Inpatient Rehab Facility (IRF), the insurance company often decides if you qualify for this level of service or if you should be discharged to home health or even hospice. The authorizing statute states that MEDICARE REPLACEMENT PLANS (Medicare Advantage) must cover the same services Medicare covers, but some insurance companies have been known to continually deny coverage for post-acute care.

MEDICARE REPLACEMENT PLANS negatively impact patients and the healthcare system

MEDICARE REPLACEMENT PLANS (Medicare Advantage) are focused on decreasing the amount they spend on healthcare providers. This may sound prudent, but there are two costs which must be fully understood. The first is the cost of the patient’s well-being. Medicare recipients have a right to receive the care they deserve, and have spent their lifetimes funding through personal withholdings from their paychecks. Second, hospitals, rehab centers and nursing homes rely on a certain level of occupancy to maintain their buildings and robust operations. This, ultimately, drives their revenue. If MEDICARE REPLACEMENT PLANS (Medicare Advantage) are denying care to Medicare recipients, patients do not receive the care they need and deserve — which means health care facilities are left trying to make ends meet on declining revenue. This is one reason so many hospitals are struggling, and some eventually close — leaving communities at risk.

Many healthcare providers consider the growth of MEDICARE REPLACEMENT PLANS (Medicare Advantage) a significant threat to the healthcare system. Dollars which should be funding the system are being systematically moved to insurance company coffers while patients and providers suffer. The commissions paid to the insurance agent to sell someone a MEDICARE REPLACEMENT PLAN (Medicare Advantage) can be more than double the commission paid to sell a regular Supplemental or Medigap policy. The CEOs of these large companies make huge salaries, with even larger incentive packages. In fact, the CEOs of two different health insurance companies have a compensation package of over $20 million a year! The financial deck is stacked against patients with a MEDICARE REPLACEMENT PLAN (Medicare Advantage).

MEDICARE REPLACEMENT PLANS (Medicare Advantage) claim that they save the government money. However, in 2019, Medicare spent $321 more per person for Medicare Advantage enrollees than it would have spent for the same beneficiaries had they been covered under traditional Medicare. To further illustrate just how regressive the system is, the MEDICARE REPLACEMENT PLANS (Medicare Advantage) get paid on how sick the patients are — the more diagnoses they list for each participant, the more profit they generate. And the fewer healthcare dollars they spend! In fact, there are currently whistle-blower cases against MEDICARE REPLACEMENT PLANS (Medicare Advantage) companies related to some doctors allegedly being strong-armed into adding multiple diagnoses to generate revenue. These actions are so egregious, the Department of Justice has joined in many of the whistleblower cases.

MEDICARE REPLACEMENT PLANS negatively impact local economies

The economic impact of healthcare dollars on local economies is significant. On average, every dollar that is paid into a local economy generates $5 of economic impact. So, if insurance companies are withholding dollars from your local hospital by influencing your healthcare, they are negatively impacting the financial well-being of your local community and job market.